Total Rewards Statements: Investing in Employees

Posted by Lindsay Hill, CCP, GRP, Director of Compensation Services on December 28, 2023

Tags: Employee Benefits

Total rewards, at a high level, are split into two categories:

- direct compensation (i.e., salary), and

- indirect compensation (i.e., benefits, schedule, training, development, etc.).

These two pieces work together to reward employees for performing work on behalf of the company and ideally motivate them to continue working toward the company's goals.

What is a TRS?

A total rewards statement (TRS) is a comprehensive listing of the rewards provided, including monetary values, that holistically captures the total investment a company is making in its employees. A TRS is individualized to each employee's benefit enrollment, salary & bonus structure, and ideally includes a letter or positive acknowledgment of the employee's efforts to further the company's objectives.

Not all rewards are easy to understand or conceptualize, especially when referring to intangible benefits such as flexible hours, or a hybrid or fully remote setting. How does a company put a price on working remotely? Most people see this as a privilege and a perk, but what if a remote work setting is valued differently by employee populations? Sometimes it doesn't make sense to monetize the value of everything, but there are various categories to consider when you create a total rewards statement.

Rewards Categories

Broad categories are helpful to include as they further segment the rewards into themed areas such as Health, Work-Life, Retirement, Compensation, Paid Time Off, and more. Once you have identified categories, individual rewards can be listed. Here are sample line-item rewards within standard categories:

- Compensation

- Annual Salary

- Bonus

- Commission

- Paid Time Off

- Vacation

- Sick

- Holiday

- Bereavement

- Catastrophic Leave

- Benefits (Mandated)

- Worker's Compensation

- Social Security

- Medicare

- FUTA Tax

- Benefits (Insurance)

- Medical

- Dental

- Vision

- Life Insurance

- Long-term Disability

- Short-term Disability

- Health Savings Account

- Work/Life

- Employee Assistance Program

- Tuition Reimbursement

- Training/Development

- Wellness

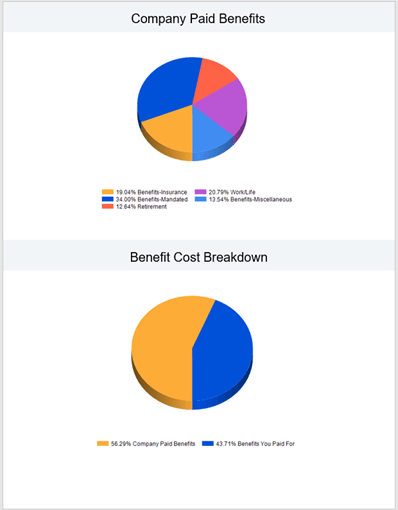

Breaking it down even further, the contributions made by the company and those made by the employee can be highlighted separately and shown in a pie chart or another graphical form to demonstrate the company's investments alongside the employee's investments in rewards.

Breaking it down even further, the contributions made by the company and those made by the employee can be highlighted separately and shown in a pie chart or another graphical form to demonstrate the company's investments alongside the employee's investments in rewards.

Showing and explaining the total investment being made in employees can create feelings of goodwill, increase trust, and help employees understand they are receiving more than their direct compensation (salary) each month or every other week on payday. Educating employees on unseen investments can be eye-opening and help the company be strategic in its investments too.

The rewards mix offered by any company is strategic and most importantly should be tailored to the company's workforce and their needs to maximize returns on investments. You likely already have the information needed to develop statements for employees, it's just a matter of separating the information applicable to each employee and formatting it in an understandable way.

Want to learn more?

Attend our upcoming HR Connect training on February 28, 2024, Total Reward Statements – The Answer to How Much Do I Really Make?

If any of this sounds a bit overwhelming to start on your own, or if you are short on time, let CEA’s sister association, Cascade Employers Association, develop your total reward statements for you! To welcome in 2024, we’re starting the new year with 25% off our hourly rate on total reward statement creations through March 15, 2024. Reach out to our Compensation team for a quote now.