California’s PAGA Reform: New Opportunities for Employers

Posted by on August 1, 2024

Tags: Employers Report

On July 1, 2024, Assembly Bill 2288 and Senate Bill 92 were signed into law, significantly reforming California’s Private Attorneys General Act (PAGA). The reforms mark impactful changes to how wage-and-hour lawsuits will be litigated going forward. The changes apply to PAGA cases filed on or after June 19, 2024.

On July 1, 2024, Assembly Bill 2288 and Senate Bill 92 were signed into law, significantly reforming California’s Private Attorneys General Act (PAGA). The reforms mark impactful changes to how wage-and-hour lawsuits will be litigated going forward. The changes apply to PAGA cases filed on or after June 19, 2024.

In this article, we are focusing on just one important aspect of the PAGA reform: the new opportunity for employers to reduce their penalties if hit with a PAGA lawsuit, by demonstrating they took reasonable steps to comply with wage and hour laws.

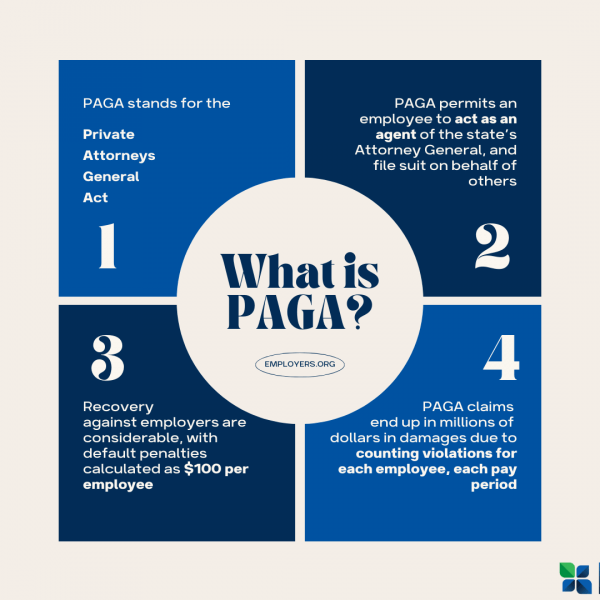

What is PAGA?

PAGA is a complex law, but in short, it authorizes discontented employees to file lawsuits to recover civil penalties on behalf of themselves, other employees, and the State of California for Labor Code violations (e.g., wage and hour claims).

PAGA claims are often initiated when a terminated or disgruntled employee reaches out to an attorney, and an attorney starts reviewing their payroll records for errors, such as wage statement violations, missed meal and rest breaks, overtime issues, or mistakes in calculating an employee’s regular rate of pay, as some common examples. PAGA penalties are in addition to unpaid wages owed to an employee. Many small and mid-size employers often end up settling PAGA lawsuits, due to costly legal fees.

What are the new opportunities for employers?

Previously, employers were subject to a civil penalty of $100 per employee per pay period for an initial Labor Code violation and $200 per employee for a subsequent violation. The amendments now incentivize employers to “take all reasonable steps to be in compliance” with the Labor Code, as this will reduce these potential penalties. For example:

- The amounts above will be capped at 15% when an employer shows it took all reasonable steps to comply with the Labor Code, prior to receiving a PAGA notice (e.g., from an attorney) or request for personnel records;

- The amounts above will be capped at 30% when an employer takes reasonable steps within 60 days of receiving a PAGA notice, to address the issues raised in the PAGA notice.

What are the reasonable steps employers should take?

So you may be wondering—what exactly are the “reasonable steps” employers should take? The law lists the following examples:

- Conducting periodic payroll audits and taking action in response to audit results when out of compliance

- Disseminating lawful written policies

- Training supervisors on applicable Labor Code and wage order compliance

- Taking appropriate corrective action for supervisors who are not following your policies

Whether the employer’s conduct is considered reasonable is evaluated “by the totality of the circumstances and taking into consideration the size and resources available to the employer, and the nature, severity and duration of the alleged violations.”

What should employers do next?

The law now provides some much needed grace to California employers, but only if employers take advantage of the new rules. We recommend incorporating frequent payroll audits and wage-and-hour training for supervisors into your HR processes. It is more critical than ever that supervisors understand employees’ wage and hour rights, and stay on top of tracking time records and catching errors.

CEA members may access our Wage and Hour Checklist on our HR Forms page, for immediate use to help your supervisors track compliance!