Employer's Report: Employers Report Post

Read our CEA monthly newsletter, curated and written by our team of experts.

Missing out on the action?

Pitfalls of Unlimited PTO Policies

Posted by Giuliana Gabriel, J.D., HR Compliance Director on February 1, 2024

Tags: Employers Report

Unlimited Paid-Time-Off Programs have gained popularity amongst many employers, but is unlimited PTO really the way to go? There are a number of reasons California employers are cautioned against these plans, ranging from employee satisfaction to compliance. If you have an unlimited PTO policy or are contemplating one, make sure you consider the following:

Employee Satisfaction

While unlimited PTO might sound enticing during the recruiting process, many employees become disillusioned by these programs. Statistically, employees who fall under unlimited PTO programs end up taking off less time than those who accrue their benefits. The ambiguities surrounding an unlimited PTO program can often leave people wondering exactly what amount of time taken off would be frowned upon by management. Many employees are skeptical whether it is truly unlimited. And, savvy employees will figure out that most unlimited PTO programs do not have any cash out value should they leave your employment.

Compliance Concerns

In California, unlimited PTO also creates compliance concerns for employers. For example, there is an argument that if PTO is truly unlimited it could turn every leave of absence into a fully paid leave. For example, if an employee goes out on a lengthy family and medical leave (under CFRA/FMLA), or needs to take leave as a reasonable accommodation (under ADA/FEHA), you may be on the hook to pay for the employee’s entire absence.

We also recommend having a separate mandatory paid sick leave policy, to ensure compliance with California’s requirements and to avoid extending all of California’s PSL protections to your unlimited PTO program.

Some things are too good to be true and Unlimited PTO plans for businesses in California may fall into that category. For those employers with unlimited PTO policies, we recommend you consult legal counsel on these potential risks, and also include the strongest policy language possible to carve out protected leaves of absence from your unlimited PTO program.

Do you need additional guidance or assistance with handbook policy customization? Reach out to CEA’s HR experts at 800.399.5331!

Relaxed Rules on COVID Exclusion Periods

Posted by Giuliana Gabriel, J.D., HR Compliance Director on February 1, 2024

Tags: Employers Report

On January 9, 2024, the California Department of Public Health (CDPH) significantly relaxed the rules on COVID exclusion periods, moving away from the 5-day isolation requirement after someone tests positive.

Most COVID-19 workplace rules are found in Cal/OSHA’s Permanent COVID Standard, which went into effect on February 3, 2023, and will remain in effect until February 3, 2025, with record-keeping obligations lasting until February 3, 2026.

However, for certain requirements, such as isolation and quarantine guidelines, Cal/OSHA instructs employers to defer to CDPH or, if applicable, the local health department with jurisdiction over the workplace.

Good News on CDPH’s Changes:

Positive Cases:

- If someone tests positive but has NO symptoms: they are no longer required to be excluded from the workplace.

- If someone tests positive and HAS symptoms: they must stay home for a minimum of 24 hours. They can return only if they satisfy the following: (1) they have not had a fever for 24 hours without using fever-reducing medication AND (2) other COVID-19 symptoms are mild and improving.

- Mask whether symptomatic or not: Even if someone is allowed to return to the workplace, everyone who tests positive must mask for a minimum of 10 days when around other people indoors. (Day 0 is the symptom onset date or positive test date if they don’t have any symptoms.) They may remove the mask sooner than 10 days if they have two sequential negative tests at least one day apart.

Infectious Period:

The potential infectious period is 2 days before the date of symptoms began or the positive test date (if no symptoms) through Day 10. The infectious period is used for determining who is a close contact.

Infected persons who end isolation in accordance with CDPH guidance (as noted above) are no longer considered to be within their infectious period. This means that, under current guidance, there is no infectious period for asymptomatic employees. The infectious period may vary for symptomatic employees, depending on when they meet the criteria to return to work.

Close Contacts:

- If someone has COVID-19 symptoms following close contact: they should test and mask immediately.

- If someone does not have COVID-19 symptoms following close contact: CDPH still encourages testing, and masking around higher-risk individuals.

CEA is Here to Help you!

CEA members have access to our COVID-19 Exposure Tool Kit to help walk you through the required steps, and you may give us a call for further clarification at 800.399.5331

Valentine’s Day Deadline for California Employers

Posted by Giuliana Gabriel, J.D., HR Compliance Director on February 1, 2024

Tags: Employers Report

Many out-of-state employers are surprised to learn that California employers cannot prevent former employees from working for competitors. Non-compete agreements in California are generally not enforceable, as they are prohibited by California Business and Professions Code section 16600. Many other states will enforce such agreements if they are reasonable (based on length of time, geographic boundaries, etc.).

New California Laws for 2024

Now, a new California law for 2024, AB 1076, requires employers to notify certain current and former employees that they entered into a void non-compete agreement, by February 14, 2024. Specifically, employers must send a written, individualized communication to all current and former employees who were employed after January 1, 2022 and entered into a non-compete clause or agreement (not subject to an exception). The agreement must notify the employee the clause and/or agreement is void, and it must be sent to their last known address and email address. Violations constitute an act of unfair competition under the Business and Professions Code.

With less than two weeks away from the Valentine’s Day deadline, it is important that employers audit their agreements and contractual provisions now, and begin preparing the notices, if applicable.

Of note, another new law, SB 699, now allows current, former, and prospective employees to sue if they entered into a void non-compete agreement or the company attempted to enforce one. Previously, there were no monetary consequences for California employers who executed unenforceable non-competes. Rather, courts would just find them unenforceable if challenged. Now, employees can sue for monetary damages and their attorney’s fees. Furthermore, SB 699 provides that these protections apply regardless of where and when the contract was signed, including if the employment was maintained outside of California. This covers:

- California-based companies who enter into non-compete agreements with California employees or out-of-state employees

- Companies outside of California who enter into non-compete agreements with California employees

California employers may still enforce reasonable confidentiality, intellectual property assignment, and non-disclosure agreements.

So remember, by this Valentine’s Day, notify workers who entered into non-competes that they don’t have to “commit” to you-yes, pun intended.

What else makes California unique? Learn more on our What’s Different in California page for employers, and reach out to us for assistance at 800.399.5331.

Kim’s Message: Invest More to Get More

Posted by Kim Gusman, President & CEO on February 1, 2024

Tags: Employers Report

In last year’s February’s newsletter I wrote about how Valentine’s Day is a good time to show those who you care about some love, and also a good time to show your employees how much you value and appreciate them. I referenced a great book by authors Eric Mosely and Derek Irvine, called Making Work Human, How Human Centered Companies are Changing the Future of Work and the World.

In the book, Mosely and Irvine explain that successful leaders TALK with employees, THANK them for all that they do and CELEBRATE with them throughout the year. And, they teach leaders that team building happens organically when we make memories with our employees and mark life’s moments together.

Making the Extra Effort

I still believe in that book and in building human-centered companies, but this year I’m taking it one step further-like most improvements in life, you’ve got to put more into it if you want to get more out of it. Whether it’s your personal relationships, your fitness routine (especially your fitness routine!), or your workforce, you’ve got to invest more time, effort, money, energy, and/or tools into those things that are important to you if you want to see better results.

So as leaders, in addition to thanking, talking and celebrating with our employees, how can we take things one step further? Here’s your answer-invest in your employees with Upskilling. While not a new concept, Upskilling is the process of learning new skills or of teaching workers new skills. Some employers put this on the back burner during those COVID years.

Do you offer additional training or resources to help your employees advance in their careers? Upskilling can take many forms, such as taking online courses, attending workshops, conferences, or participating in on-the-job training programs. The vast majority of employees want more education on the job, and they tend to stay longer with employers who invest in them.

In 2022, we created a Leadership Course (L.E.A.D) specifically for upskilling the leaders of today and tomorrow. This year, we are proud to launch another upskilling certification series beginning March 5, 2024 called Elevate Your Expertise: An Upskilling Training Series. Perfect for your entire staff, this class is held virtually, two hours each week for four weeks. Register your team today on some of the most common training topics requested by employers:

- WEEK 1 (Tuesday, March 5): Workplace Communication: Communicating Confidently and Effectively

- WEEK 2 (Tuesday, March 12): Mastering Team Collaboration in the Workplace

- WEEK 3 (Tuesday, March 19): Analytical Thinking and Problem Solving in the Workplace

- WEEK 4 (Tuesday, March 26): Self Leadership: Bringing Your Best Self to Work

Life moves fast and technology changes even more quickly. As technology and the economy evolve rapidly, the skills needed in the job market are also transforming. Upskilling is a win/win and who doesn’t love that?! It will help your company stay competitive and increase job satisfaction for your workforce!

Happy Valentine’s Day!

Soar into 2024 with New Trainings!

Posted by [Add the Author Here] on January 1, 2024

Tags: Employers Report

Help your business and employee soar in 2024 by signing up for trainings that will help you stay compliant and meet your goals this year. Don’t miss out on the 2024 Labor Law Update *Sponsored by Sandler Training, and Tips for Your Employee Handbook in January.

5 Things You Didn’t Know About…

Posted by California Employers Association on January 1, 2024

Tags: Employers Report

This month we’d like to introduce you to two-thirds of CEA’s amazing operations department: Andrea Frederickson, Controller and Jennifer Guerrero, Operations.

Andrea Frederickson, Controller, CEA

Andrea Frederickson, Controller, CEA1. How long have you been with CEA?

4 years.

2. What was your first job?

I worked at a grocery store in the bakery and ice cream shop.

3. Where did you grow up?

Utah and Colorado, but I have lived most of my adult life in Texas.

4. What is something most people don’t know about you?

I play the piano and am learning the cello.

5. What was your favorite class in college?

It’s a toss up between humanities and a furniture upholstery class; that was a lot of fun.

Jennifer Guerrero, Operations, CEA

Jennifer Guerrero, Operations, CEA1. When you are at work, how do you motivate yourself?

Lots of coffee!

2. What advice would you give to someone who is just starting their career?

Be open to soak in everything that comes at you. Be it good or bad…you will learn from every moment.

3. What was your first job?

Retail Associate at Nordstrom

4. Where did you grow up?

San Francisco, CA

5. What is your favorite quote, motto, or words you live by?

Always have a smile on your face when answering the phone. That person on the other end may need one.

Just Because you Offer an EAP Plan Doesn’t Mean Employees Have to Use it

Posted by Kim Gusman, President & CEO on January 1, 2024

Tags: Employers Report

Just when you think people are getting smarter, here’s a crazy story that goes from bad to worse. I am calling this “three strikes and you are sued!” Weis Markets recently fired an employee when she refused to participate in the company’s employee assistance program (EAP), and now they are being sued by the U.S. Equal Employment Opportunity Commission (EEOC). Read on to see the three mistakes made that resulted in a lawsuit.

- Mistake Number One: The EEOC said a supervisor at Weis Markets’ Mifflintown, Pa., store made frequent sexual comments in the workplace, often winked at the employee, kissed her without consent and made statements indicating his propensity to commit violent acts. After the employee reported the sexual harassment and the supervisor admitted some of his conduct, the company failed to take reasonable corrective action against the supervisor.

- Mistake Number Two: After the employee’s sexual harassment complaint, the company told her that co-workers had complained about her, and as a result, she would be required to participate in the EAP. A formal referral is not mandatory and does not result in disciplinary action for noncompliance. In this case, a company official confirmed to the employee that the referral was to determine whether she would be placed on disability leave.

- Mistake Number Three: When the employee refused to comply with the mandatory EAP referral, Weis Markets suspended her without pay and ultimately fired her. The EEOC stated that the alleged conduct violates the Americans with Disabilities Act (ADA)-which prohibits employers from requiring employees to undergo medical examinations or answer questions that are likely to reveal whether they have disabilities, unless the employer can show the examinations or inquiries are job-related and consistent with business necessity. The ADA also prohibits retaliating against employees for opposing illegal practices, such as requiring someone to use an EAP.

Time for a Lawsuit

In October, the EEOC sued Weis Markets for “Sexual Harassment and Unlawful Use of Employee Assistance Program” charging that the grocery chain subjected the employee to Sexual Harassment and then fired her for refusing to cooperate with an illegal medical exam. “Employees have a right under the ADA not to be forced by their employers to participate in medical exams and inquiries that are not job-related and consistent with business necessity,” said Jamie Williamson, the EEOC’s Philadelphia district director. “The EEOC will not permit employers to interfere with that important ADA right or to retaliate against employees who exercise it.”

More About EAPs

An employee assistance program (EAP) is a voluntary, work-based program that offers free and confidential assessments, short-term counseling, referrals and follow up services to employees who have personal and/or work related problems. Traditionally, EAPs assisted workers with issues like alcohol or substance misuse; however, most now cover a broad range of issues such as child or elder care, relationship challenges, financial or legal problems, wellness matters and traumatic events like workplace violence. These programs are free for employees and offered by stand-alone EAP vendors or providers who are part of comprehensive health insurance plans.

EAPs that offer medical benefits such as direct counseling and treatment rather than just referrals for counseling and treatment are regulated under ERISA and subject to COBRA. Generally, EAPs are confidential, meaning the employer won’t find out about any information employees discuss with the EAP, such as medical diagnoses or family problems. EAPs in California are subject to the federal Health Information Portability and Accountability Act (HIPAA). Under HIPAA, an employer cannot require an employee to disclose personal medical information.

Total Rewards Statements: Investing in Employees

Posted by Lindsay Hill, CCP, GRP, Director of Compensation Services, Cascade Employers Associations on January 1, 2024

Tags: Employers Report

Total rewards, at a high level, are split into two categories:

- direct compensation (i.e., salary), and

- indirect compensation (i.e., benefits, schedule, training, development, etc.).

These two pieces work together to reward employees for performing work on behalf of the company and ideally motivate them to continue working toward the company’s goals.

What is a TRS?

A total rewards statement (TRS) is a comprehensive listing of the rewards provided, including monetary values, that holistically captures the total investment a company is making in its employees. A TRS is individualized to each employee’s benefit enrollment, salary & bonus structure, and ideally includes a letter or positive acknowledgment of the employee’s efforts to further the company’s objectives.

Not all rewards are easy to understand or conceptualize, especially when referring to intangible benefits such as flexible hours, or a hybrid or fully remote setting. How does a company put a price on working remotely? Most people see this as a privilege and a perk, but what if a remote work setting is valued differently by employee populations? Sometimes it doesn’t make sense to monetize the value of everything, but there are various categories to consider when you create a total rewards statement.

Rewards Categories

Broad categories are helpful to include as they further segment the rewards into themed areas such as Health, Work-Life, Retirement, Compensation, Paid Time Off, and more. Once you have identified categories, individual rewards can be listed. Here are sample line-item rewards within standard categories:

- Compensation

- Annual Salary

- Bonus

- Commission

- Paid Time Off

- Vacation

- Sick

- Holiday

- Bereavement

- Catastrophic Leave

- Benefits (Mandated)

- Worker’s Compensation

- Social Security

- Medicare

- FUTA Tax

- Benefits (Insurance)

- Medical

- Dental

- Vision

- Life Insurance

- Long-term Disability

- Short-term Disability

- Health Savings Account

- Work/Life

- Employee Assistance Program

- Tuition Reimbursement

- Training/Development

- Wellness

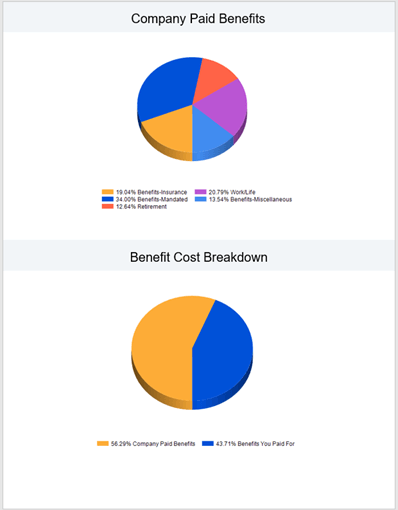

Breaking it down even further, the contributions made by the company and those made by the employee can be highlighted separately and shown in a pie chart or another graphical form to demonstrate the company’s investments alongside the employee’s investments in rewards.

Breaking it down even further, the contributions made by the company and those made by the employee can be highlighted separately and shown in a pie chart or another graphical form to demonstrate the company’s investments alongside the employee’s investments in rewards.

Showing and explaining the total investment being made in employees can create feelings of goodwill, increase trust, and help employees understand they are receiving more than their direct compensation (salary) each month or every other week on payday. Educating employees on unseen investments can be eye-opening and help the company be strategic in its investments too.

The rewards mix offered by any company is strategic and most importantly should be tailored to the company’s workforce and their needs to maximize returns on investments. You likely already have the information needed to develop statements for employees, it’s just a matter of separating the information applicable to each employee and formatting it in an understandable way.

Want to learn more?

Attend our upcoming HR Connect training on February 28, 2024, Total Reward Statements – The Answer to How Much Do I Really Make?

If any of this sounds a bit overwhelming to start on your own, or if you are short on time, let CEA’s sister association, Cascade Employers Association, develop your total reward statements for you! To welcome in 2024, we’re starting the new year with 25% off our hourly rate on total reward statement creations through March 15, 2024. Reach out to our Compensation team for a quote now.

How to Spot a Bully (and What to do About it)

Posted by Giuliana Gabriel, J.D., HR Compliance Director on January 1, 2024

Tags: Employers Report

Chances are, most of us have encountered difficult personalities in the workplace. However, when the behavior rises to the level of bullying this often presents a major challenge for managers and HR professionals as they navigate the best approach. One problem is that workplace bullies are often more sophisticated than your average schoolyard bully. Workplace bullies may leave you feeling gaslit-causing you to question whether they have done anything wrong in the first place. Moreover, rude, subtly disrespectful, and unprofessional behavior does not always fit neatly into a formal policy violation leaving managers feeling stuck.

What are the Signs of a Workplace Bully?

- They publicly shame or embarrass others. Bullies often find ways to belittle others, particularly in public. Sometimes they do this in a subtle or passive aggressive manner and then suggest that they are only joking or that the other person needs to lighten up. This is different from an employee with good intentions who accidentally says something offensive or makes someone feel bad. One characteristic of a bully is the inability to acknowledge their mistakes nor see the other person’s perspective.

- They take all the credit or fail to give credit. What lies at the heart of bullying is often underlying insecurity. Bullies typically feel the need to take all of the credit for others’ accomplishments, or they may fail to acknowledge another coworker’s hard work, or give credence to their ideas. This is an even bigger problem if the bully is in a supervisory role, leading to employee disengagement and burnout.

- They project their behavior onto others. Oftentimes when a bully is confronted about their alleged behavior they suggest that everyone else is also engaging in the same conduct they have been accused of. This can leave managers feeling stuck in a “he said, she said” situation. It is important to pay close attention to whether they can actually provide specific examples involving others, and how they reflect on their own role in the workplace conflict.

- They try to turn others against you. When a bully has decided to target someone-sometimes for no good reason at all-they will make attempts to turn others against that person. They may lie about the individual, take things out of context, or attempt to sabotage their work. Unfortunately, this can create a rumor circle that is difficult to overcome when allowed to spread.

- They create an intimidating, threatening, or hostile work environment. Sometimes bullies are bold enough to venture into illegal conduct, such as by making threats of workplace violence or targeting someone based on a protected class. This is often when bullying becomes harassment and it is critical that management investigates and corrects the issue promptly, to mitigate liability and protect other employees.

How to Address Workplace Bullies

If you are dealing with an individual that checks any or all of these boxes, the first question managers should ask can include:

- Is this the first issue we have had with this person, or is it repeated behavior?

- Does it appear they are acting intentionally or are they tone deaf?

- When confronted, does this person take accountability and show an intention to change?

- Or, do they deflect or appear to only pay lip service to doing better next time?

The answers to these questions are important when assessing whether you will attempt to coach this person to success, or if you have reached the end of the road. The worst situation occurs when a manager is unsure of how to approach a bully and fails to confront the issue for a while. This is never a good idea because just one problematic employee can vastly change your work culture, and lead to employee dissatisfaction and retention issues. Unfortunately, many employees begin to assume that the bully is protected and begin to distrust management and Human Resources. Once trust is lost amongst staff, it is very difficult to gain it back.

Managers need to remember that they do not have to prove beyond a reasonable doubt that an employee is engaged in bullying. Rather, managers just need to assess whether it is more likely than not taking into account all employee reports and other evidence, that bullying occurred and a policy was violated. Rude, unprofessional, or disrespectful behavior is often a violation of an employer’s code of conduct and/or harassment and discrimination policies. Make sure to document each incident, as it may become clear the bullying behavior is adding up.

If this article rang true, consider:

- Whether your employee could benefit from CEA’s professional coaching services.

- Let us know if you need assistance in handling an internal investigation-we can walk you through all of the steps from A-Z.

Members can also nip bad behavior in the bud and find additional guidance in our Coaching and Discipline in the Workplace Tool Kit.

Are Your Exempt Employees Really Exempt?

Posted by Giuliana Gabriel, J.D., HR Compliance Director on January 1, 2024

Tags: Employers Report

Many employers mistakenly assume they can simply pay someone a salary and classify them as “exempt,” but this is not the case. In fact, the default in California is that an employee is assumed to be an hourly (non-exempt) worker, unless the employer can demonstrate they meet the exemption standards. Not all positions are even eligible for exempt status. However, there are many advantages to classifying someone as exempt, as they are not subject to most wage and hour requirements, including timekeeping, overtime, meal and rest breaks, etc.

So what does it take to be an exempt employee? The employee must satisfy both a duties test and a salary minimum. CEA members can access our Exempt Analysis Worksheets for assistance on the duties tests. Note that exempt employees must engage in qualifying exempt duties more than 50% of the time.

- The minimum exempt salary for 2024 is $66,560/year (calculated as two times the State’s minimum wage multiplied by 2080 hours per year).

FAQs for Exempt Employees

If an exempt employee works part time or variable hours can we pro-rate or reduce their salary?

No. The hallmark of an exempt employee is that they are paid for the skills they bring to the job-not the number of hours they work. To maintain exempt status under the white-collar exemptions (i.e., executive, administrative, and professional), the employee must be paid their full salary for a workweek in which they perform any work. This is known as the “salary basis” rule. Therefore, when one of your exempt employees is absent for part of the workweek or works less hours, you should start with the assumption that they will still receive their full salary.

There are a few narrow exceptions when an employer may be permitted to make deductions from an exempt employee’s salary for qualifying full-day absences. We cover this issue in more detail in our previous blog article.

Can we require exempt employees to work specific hours?

Yes! Many employers assume that because an exempt employee is not paid by hours worked, that you cannot require a specific schedule. That is untrue. Employers are free to assign designated work shifts and/or required hours of availability to exempt employees. For example, if your business operations are Monday-Friday, 9am-5pm, you can require your exempt employees to be present and working during these hours. You can also call them to work outside of these hours, and you do not have to worry about overtime as long as they are properly classified.

Do we have to pay expense reimbursements to exempt employees?

Yes. Although exempt employees are exempt from most wage-and-hour requirements, they are still subject to a few. Business expense reimbursement is one of them. Labor Code section 2802 requires employers to reimburse all employees for all reasonable and necessary business expenses required to perform their job (e.g., office supplies, cellphone, internet, etc.). Also, don’t forget about reimbursing exempt workers for mileage when they use their personal vehicle for business travel as well!

Can we classify someone as a “salaried non-exempt” worker?

Not really. While the Labor Commissioner permits employers to pay non-exempt employees on a salaried basis, they are still hourly employees subject to all wage-and-hour requirements, to all wage-and-hour requirements, including at least earning the minimum wage for all hours worked, overtime, meal and rest breaks, etc. The number of hours they work must still be included on their paystub. This means that salaried, non-exempt employees need to track the time they work to ensure they are paid properly and that documentation is compliant. This arrangement can often complicate the regular rate of pay for calculating overtime. Due to the administrative burdens and additional confusion, it is typically not recommended to pay non-exempt employees on a salaried basis.

Additional questions? Members can contact our wage-and-hour experts at 800.399.5331.

Answers to Paid Sick Leave Questions

Posted by Giuliana Gabriel, J.D., HR Compliance Director on January 1, 2024

Tags: Employers Report

The Department of Industrial Relations (DIR) has updated their Frequently Asked Questions page to answer some of our questions regarding the new paid sick leave law (SB 616). They also updated the mandatory Paid Sick Leave poster, and Wage Theft Notice for hourly workers.

For additional information on SB 616, refer to our previous blog article here.

Ensuring Compliance by January 1, 2024:

Many employers have had questions regarding how to ensure their paid sick leave policy is compliant for the increase from 3 days/24 hours to 5 days/40 hours effective January 1, 2024. The DIR’s FAQ #15 and #16 provide helpful clarification for the accrual method, as well as when the lump sum method is based on an employee’s anniversary date:

“15. If an employer uses an accrual method and capped an employee’s yearly use of leave at 3 days or 24 hours, what must an employer do to comply with the law on January 1, 2024?”

If an employer uses an annual start date other than January 1 and implements a 12‑month use cap, that cap must change to 40 hours or 5 days on January 1, 2024. For example, if an employer uses the 12-month period of May 1 – April 30 and implements a cap and an employee used 24 hours or three days before January 1, 2024, the employer must allow the employee to use an additional 2 days or 16 hours before April 30 if the employee has accrued that additional leave.

“16. If an employer utilized the ‘up-front’ method prior to January 1, 2024 and provided an employee with 3 days or 24 hours of leave on the employee’s anniversary date during the year, what must an employer do to comply with the law on January 1, 2024?

The employer has the choice to frontload the two additional days on January 1, 2024 or move the measurement of the yearly period to January 1, 2024 and frontload five days. For example, if an employee started on May 1, 2021 and the employer used that anniversary date to frontload 3 days or 24 hours on May 1, 2023, the employer may either provide 2 days or 16 hours on January 1, 2024 and keep the May 1 date to frontload or can “reset” the frontload date to January 1, 2024 and provide the employee 5 days or 40 hours then.”

Local Paid Sick Leave Ordinances

The DIR reminds employers that if they are subject to a local paid sick leave ordinance that requires more than what the State requires, they must ensure compliance with the local ordinance. Of note, however, is that as of January 1, 2024, “local ordinances cannot contradict the state paid sick leave law” on specific topics, including: “the lending of paid sick leave, paystub statements, calculation of paid sick leave, providing notice if the leave is foreseeable, timing of payment of paid sick leave, and whether payment of sick leave is required upon termination.”

CEA members may access information on local paid sick leave ordinances in this fact sheet.

Wage Theft Notice

As a reminder, at the time of hire, employers must provide each non-exempt (hourly) employee, with a written notice regarding pay rates and intervals, the designated payday, paid sick leave information, and more for the employee to acknowledge and sign. When there are changes to this information, the employer must provide an updated written notice within seven (7) calendar days of the effective date of the change. The notice must be in the language the employer normally uses to communicate employment-related information to the employee.

The DIR recently updated their sample notice for employers to use for 2024. Keep in mind that in addition to updating hourly employees regarding the new PSL, you should also update the employee on any pay rate changes (e.g., increased minimum wage). As an aside, there is also a new requirement for 2024 that California employers notify new hires regarding applicable emergency or disaster declarations in their area (AB 636). The DIR also addresses this issue in their updated sample notice.

2024 Labor Law Poster

The DIR updated their mandatory paid sick leave poster for 2024. As a reminder, the PSL poster is just one of many required state and federal notices that must be conspicuously posted in the workplace.

If you need an all-in-one poster that includes all required notices for 2024, CEA has the 2024 poster available on our store here.

Members can call us with PSL questions at 800.399.5331!

2024 IRS Mileage Rate Increase

Posted by Kim Gusman on January 1, 2024

Tags: Employers Report

While minimum wages are increasing, the IRS gave employees who drive for company business another present this holiday season: an increase in the standard mileage rate to 67 cents/mile (up from 65.5 cents/mile) effective January 1, 2024!

On December 14, 2023 the agency announced the following rates for 2024 business travel:

- 67 cents per mile driven for business use, up 1.5 cents from 2023.

- 21 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces, a decrease of 1 cent from 2023.

- 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2023.

These rates apply to electric and hybrid-electric automobiles, as well as gasoline and diesel-powered vehicles.

Why This Matters

California’s Labor Commissioner has found that the IRS mileage reimbursement rate is “reasonable” for purposes of complying with Labor Code Section 2802. LC 2802 requires employers to reimburse employees for all reasonable and necessary business expenses, such as using one’s personal vehicle for work purposes.

We encourage employers to use the standard mileage rate to pay tax-free reimbursements to employees who use their own vehicles for business, as an alternative to tracking actual costs for operating an automobile for business use.

Remember, expense reimbursements apply to salaried and hourly employees alike. For your hourly workers, note that business travel beyond their normal commute is also compensable work time. This is separate from the mileage reimbursement they receive for use of their personal vehicle for work purposes.

Next Steps

- Review your expense reimbursement policies.

- Utilizing the IRS mileage reimbursement rate for your employees is smart and easy because it covers all expenses including gas, insurance, and vehicle maintenance.

- Notify your controller, bookkeeper or whomever facilitates your expense reimbursements of this new 2024 increase.

- Review your remote worker policy-is it time for an update? Have you clearly designated and documented your 100% remote employees vs. hybrid employees?

- It’s important that you are accurately paying your employees not only for their drive time but also for any business expenses incurred on behalf of your company.

More questions? Members can call us or email us at no charge: 800.399.5331 or CEAinfo@employers.org.