Employer's Report: Employers Report Post

Read our CEA monthly newsletter, curated and written by our team of experts.

Missing out on the action?

2025 Minimum Wage Increase

Posted by Giuliana Gabriel, J.D., Vice President of Human Resources on August 27, 2024

Tags: Employers Report

We may still be in 2024, however, many of us have already been reminded to review next year’s budget, with the announcement of 2025 minimum wage increases.

As of January 1, 2025, California’s minimum wage will increase by 50 cents to $16.50/hour. Remember, minimum wages also impact exempt employee salary requirements. For exempt classification, in addition to the duties test (for administrative, professional, and executive exemptions), an employee must earn two times the State’s minimum wage (multiplied by 2080 hours/year). That means the minimum exempt salary will bump up to $68,640 annually in 2025!

Why the Increase?

It may feel like these minimum wage increases have become inevitable each year. The culprit? Inflation. After the state minimum wage reached $15.00 an hour in 2023, the rate is adjusted annually for inflation based on the national consumer price index for urban wage earners and clerical workers (CPI-W). The highest raise allowed in any one year is 3.5 percent. This year, the CPI increased by 3.18%, which results in the 50 cent increase.

Note that if Prop 32 passes on the November 2024 ballot this year, the minimum wage will be further increased-to $18.00/hour in 2025 (for businesses with 26 or more employees), and to $17.00/hour in 2025 (for businesses with 25 or fewer employees).

Industry-Specific Wages

Certain businesses are subject to industry specific minimum wage and salary requirements. For fast food workers at limited-service restaurants that are part of chains with over 60 locations nationally, they saw an increase to $20.00/hour as of April 1, 2024.

For healthcare workers, increases may go into effect as early as October 15, 2024; if not, the increase will happen on January 1, 2025, and will initially range from $18/hour to $23/hour, with set future increases thereafter. Whether the increase happens in October or January depends on the State’s budget.

Hotel workers in various cities also have a different minimum wage rate than the rest of the State.

Local Minimum Wages

Many jurisdictions in California have enacted their own minimum wage ordinances requiring that employers pay higher minimum wages for work performed within their geographical boundaries. Remember to check local minimum wages if you have remote non-exempt workers, including those working from home or on a hybrid schedule, and/or when you send workers to various job sites in different cities or counties. Refer to CEA’s Local Minimum Wage Fact Sheet.

Budgeting Tips

In budgeting for 2025, employers should calculate how increases will impact their bottom line. Some questions to consider include:

- Should we reclassify any employees from exempt to non-exempt based on the new minimum salary of $68,640 for 2025? It’s okay to do this at any time throughout the year, but you will want to communicate with affected employees first to discuss wage and hour rules, clocking in and out, etc.

- Should we raise our prices on our products or services to account for the wage increases?

- Do we need to consider any furloughs or layoffs in 2025 to stay financially healthy?

At CEA, we are experienced in getting creative in finding HR solutions that are legal and work for your business. CEA members may call us on our HR support line for additional guidance, at 800.399.5331 or email us at ceainfo@employers.org.

Hot Trainings for the End of Summer

Posted by California Employers Association on August 1, 2024

Tags: Employers Report

Member Appreciation Month is finally here! Register TODAY for any or all of our (complimentary for members) August virtual events. One attendee will be selected from each Member Appreciation Month webinar to receive a $50 gift card from See’s Candies. Don’t forget to check out our new offerings in September including HR 101: Compliance Essentials Certification Series.

California’s PAGA Reform: New Opportunities for Employers

Posted by Giuliana Gabriel, J.D., Vice President of Human Resources on August 1, 2024

Tags: Employers Report

On July 1, 2024, Assembly Bill 2288 and Senate Bill 92 were signed into law, significantly reforming California’s Private Attorneys General Act (PAGA). The reforms mark impactful changes to how wage-and-hour lawsuits will be litigated going forward. The changes apply to PAGA cases filed on or after June 19, 2024.

On July 1, 2024, Assembly Bill 2288 and Senate Bill 92 were signed into law, significantly reforming California’s Private Attorneys General Act (PAGA). The reforms mark impactful changes to how wage-and-hour lawsuits will be litigated going forward. The changes apply to PAGA cases filed on or after June 19, 2024.

In this article, we are focusing on just one important aspect of the PAGA reform: the new opportunity for employers to reduce their penalties if hit with a PAGA lawsuit, by demonstrating they took reasonable steps to comply with wage and hour laws.

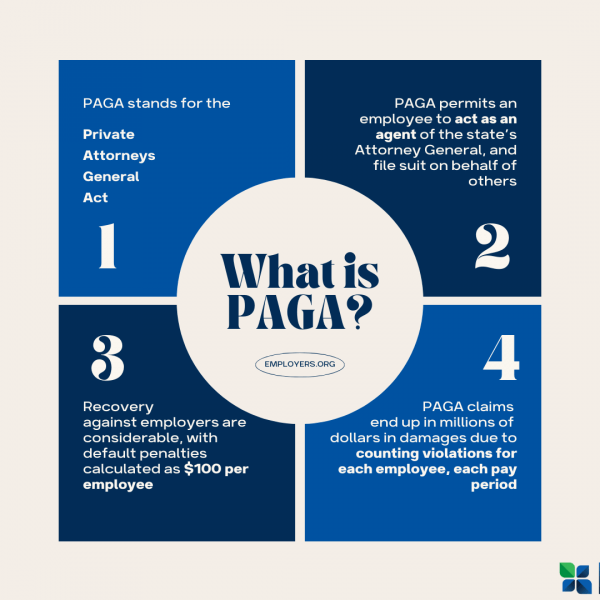

What is PAGA?

PAGA is a complex law, but in short, it authorizes discontented employees to file lawsuits to recover civil penalties on behalf of themselves, other employees, and the State of California for Labor Code violations (e.g., wage and hour claims).

PAGA claims are often initiated when a terminated or disgruntled employee reaches out to an attorney, and an attorney starts reviewing their payroll records for errors, such as wage statement violations, missed meal and rest breaks, overtime issues, or mistakes in calculating an employee’s regular rate of pay, as some common examples. PAGA penalties are in addition to unpaid wages owed to an employee. Many small and mid-size employers often end up settling PAGA lawsuits, due to costly legal fees.

What are the new opportunities for employers?

Previously, employers were subject to a civil penalty of $100 per employee per pay period for an initial Labor Code violation and $200 per employee for a subsequent violation. The amendments now incentivize employers to “take all reasonable steps to be in compliance” with the Labor Code, as this will reduce these potential penalties. For example:

- The amounts above will be capped at 15% when an employer shows it took all reasonable steps to comply with the Labor Code, prior to receiving a PAGA notice (e.g., from an attorney) or request for personnel records;

- The amounts above will be capped at 30% when an employer takes reasonable steps within 60 days of receiving a PAGA notice, to address the issues raised in the PAGA notice.

What are the reasonable steps employers should take?

So you may be wondering-what exactly are the “reasonable steps” employers should take? The law lists the following examples:

- Conducting periodic payroll audits and taking action in response to audit results when out of compliance

- Disseminating lawful written policies

- Training supervisors on applicable Labor Code and wage order compliance

- Taking appropriate corrective action for supervisors who are not following your policies

Whether the employer’s conduct is considered reasonable is evaluated “by the totality of the circumstances and taking into consideration the size and resources available to the employer, and the nature, severity and duration of the alleged violations.”

What should employers do next?

The law now provides some much needed grace to California employers, but only if employers take advantage of the new rules. We recommend incorporating frequent payroll audits and wage-and-hour training for supervisors into your HR processes. It is more critical than ever that supervisors understand employees’ wage and hour rights, and stay on top of tracking time records and catching errors.

CEA members may access our Wage and Hour Checklist on our HR Forms page, for immediate use to help your supervisors track compliance!

USERRA May Require Paid Leave

Posted by California Employers Association on August 1, 2024

Tags: Employers Report

On May 21, 2024, the U.S. Court of Appeals for the 3rd Circuit held that short-term military leave may be comparable to jury duty leave and bereavement leave and therefore may be subject to payment if the employer compensates jury duty and bereavement leave. The 3rd Circuit has jurisdiction over Delaware, New Jersey and Pennsylvania. However, the case may be cited as persuasive authority in other jurisdictions, so employers everywhere, including in California, should pay attention.

The opinion was issued in Scanlan v. American Airlines, Inc., reversing a lower court’s summary judgment ruling in favor of the airline and reinstating and remanding the plaintiff pilots’ class action suit for further proceedings. The plaintiffs claim their employer, American Airlines, violated The Uniformed Services Employee and Reemployment Rights Act (USERRA) by denying paid leave for short-term military absences (of no more than 16 days) from Jan. 1, 2013, through Oct. 31, 2021.

USERRA

USERRA provides job protections for U.S. service members returning from military leave, including granting them the same rights and benefits as employees having similar seniority, status and pay who are on furlough or leave of absence. As the Scanlan court noted, the 3rd Circuit already held in Travers v. Fed. Express Corp. that “rights and benefits” include pay while on leave. The 7th and 9th Circuits have issued similar decisions. The USERRA regulations clarify that employees on military leave are entitled to the most favorable treatment accorded to any comparable form of leave. Factors to consider in determining whether leaves are comparable include the duration of the leave, the purpose of the leave and the ability of the employee to choose when to take the leave.

Scanlan v. American Airlines-Comparability

The district court had held that no reasonable jury could find that the leaves were comparable. First, on the duration prong of the analysis, the lower court found that, despite the similarity in the lengths of the individual instances of the leaves, military leave recurred on a regular basis over a number of years, while the other forms of leave were short-term and sporadic.

The 3rd Circuit reversed, holding that it was up to a jury to decide whether the frequency of leaves should be considered and whether the purpose and control factors were comparable, given conflicting evidence presented by the parties.

Takeaway: If you offer short-duration paid leaves such as jury duty and bereavement leave, which are not required in California, you may be required to compensate short-duration military service leaves. Employers are encouraged to consult legal counsel as this issue comes up. We will keep you updated if there is further development around this ruling. For additional guidance, CEA members may download our USERRA/Military Service Leave Tool kit on our Tool Kits page.

Poor Attendance or Protected Leave?

Posted by Giuliana Gabriel, J.D., Vice President of Human Resources on August 1, 2024

Tags: Employers Report

A common, but often frustrating dilemma for HR professionals and managers occurs when an employee is experiencing attendance issues for a variety of reasons. For example, one day your employee missed work due to “car trouble,” on another occasion they were late because they were “not feeling well,” and yet another time they missed work due to a vague personal emergency.

Managers must often navigate through muddy attendance waters and be careful not to take action against an employee based on a legally protected leave. One common mistake managers make is lumping all absences together and using that as a reason to discipline an employee for “poor attendance,” without taking each absence on a case-by-case basis to determine protected status.

Details and Documentation

It is critical that managers determine the reason for each absence and then document it in the employee’s personnel file. If the employee provides a vague reason such as a “personal emergency,” you may inform them that you need additional details to determine what leaves of absence may apply. If the employee refuses to provide details, you may advise them that the absence could count against their attendance without more information.

However, in California, an employer should never ask an employee for their confidential medical information, such as diagnostic information. Employers may generally request a doctor’s note or medical certification to substantiate that the reason they were out was medically-related, only after an employee has exhausted their mandatory sick time.

Determining if Leave is Protected

The next step is determining whether the leave time is protected and/or whether the employee violated your attendance policies. If the absence is protected, it should not count against attendance, nor should the employee face disciplinary action for it.

In addition to mandatory paid sick leave, there are over twenty mandatory leaves that may apply in California. Two of the most familiar are the California Family Rights Act (CFRA) and the federal Family and Medical Leave Act (FMLA), which allow qualifying employees to miss up to 12 weeks of work in a 12-month period, either continuously or intermittently, for covered reasons.

Need a list and descriptions of mandatory leaves in California? CEA members may access our comprehensive California Leave Laws Guide on our HR Forms Page.

Get in Compliance: Workplace Violence Prevention Requirements!

Posted by Giuliana Gabriel, J.D., Vice President of Human Resources on August 1, 2024

Tags: Employers Report

As a reminder, July 1, 2024 was the deadline for virtually all California employers to have a written Workplace Violence Prevention Plan (WVPP) and provide initial training to employees on the employer’s plan. If you missed the deadline, does that mean you should throw your hands up in the air and give up? Of course not! We do, however, recommend that you begin working to get in compliance as soon as possible. Below are some important reminders regarding the employee training requirements. Get some time scheduled on your calendar now!

Required WVPP Employee Training:

General Requirements

- Your trainer must be knowledgeable about the employer’s specific WVPP,

- the training must be customized to your workplace, specifically any hazards and threats,

- and it must be interactive and allow for employee questions and answers by someone knowledgeable in the employer’s plan.

Employers must use training material appropriate in content and vocabulary to the educational level, literacy, and language of employees and must retain training records for one year, see Labor Code section 6401.9.

Employee training must not only be provided when the WVPP is first established (i.e., initially by July 1, 2024), upon identification of new hazards or plan changes, and then annually thereafter.

Covered Topics

The training must cover the definitions stated in Senate Bill 553, as well as:

- How to obtain a copy of the employer’s WVPP at no cost, and how to participate in development and implementation of the employer’s plan.

- How to report workplace violence incidents or concerns to the employer or law enforcement without fear of reprisal.

- Workplace violence hazards specific to the employees’ jobs, the corrective measures the employer has implemented, how to seek assistance to prevent or respond to violence, and strategies to avoid physical harm.

- The violent incident log and how to obtain copies of records pertaining to hazard identification, evaluation and correction, training records, and violent incident logs.

The training may also, but is not required to cover, the following: strategies to avoid/reduce workplace violence, including risk factors and defusing hostile situations, recognizing alerts, alarms and other warnings, escape routes, emergency medical care, and post-event trauma counseling available to employees. To supplement your training, CEA members may access free courses on many of these topics in CEA University.

Need Assistance Creating the Employee Training?

If you need assistance with creating your employee training, we have a training template available which incorporates the requirements and key definitions so you can easily present the materials to your staff. Remember, the training must be customized to your specific plan, and the trainer must be someone knowledgeable in your plan. The WVPP employee training template will have areas for you to easily customize your plan. It is available for purchase on our store here. CEA members receive a discounted rate!

Need Assistance with All Plan Requirements?

If you are just starting or in the middle of your WVPP, CEA also has a comprehensive Do-It-Yourself Package available for administrators/employers, with a 90-minute training recording and tool kit to guide you through the process. It is available on our store here. Remember, all CEA members already have access to our free WVPP Tool Kit!

The Stay Interview Advantage

Posted by Jessica Rivera MBA, PHR, SHRM-CP, Training & Coaching Director on August 1, 2024

Tags: Employers Report

We have all experienced that “too little, too late” feeling. For some of us, it may have been a small thing and for others, a major event in our lives. When we lose great employees we tend to feel this way and reflect about what more we could have done.

According to a Gallup survey, 52% of exiting employees say that their manager or organization could have done something to prevent them from leaving their job. Employees report the biggest change managers can make is to increase the frequency of meaningful conversations they have with them.

Stay interviews are a way to accomplish this, as these types of interviews make it more likely for managers to identify an employee’s concerns, roadblocks and signs of disengagement, long before an employee’s last day. Employees who don’t feel connected or valued in the workplace won’t produce their best work, impacting customers’ experience, and the company as a whole. One solution to tackling this problem is prioritizing stay interviews over exit interviews, with a greater focus on keeping our valued employees.

When leaders devote quality time to building trust and connecting with their employees, we see a highly engaged team. Stay interviews help leaders find out how they’re doing, what their goals are, what they like and what they don’t like about their jobs.

Stay interviews are dynamic sessions between managers and employees designed to uncover what keeps top performers engaged and dedicated. Unlike traditional recruitment interviews, stay interviews are more casual and they foster open conversations that reveal valuable insights.

Stay interviews can unearth valuable insights, such as the need for improved flexibility for working parents or other issues that a leader can assist with. Addressing these insights doesn’t just retain talent but also promotes improved performance. Further, this fosters a healthy discussion in the event an employee is not a good fit for their current role.

An effective way to initiate your interview is by asking the right questions of your employees to gain valuable insights. Also, when you prepare in advance for a stay interview, you will be able to address some concerns right away. Questions like, “When you come to work each day, what things do you look forward to?” allows an employee to reflect on what they do best and enjoy doing the most.

As part of Member Appreciation Month, free registration is available to CEA Members for our webinar on August 8, Stay Interview Advantage, where we will discuss the following:

- Proven strategies to establish trust and rapport with employees

- Effective questions to gain insight into employee satisfaction and engagement.

- Developing personalized retention strategies

- Implementing successful practices for documenting and following up on stay interview discussions.

This is an interactive webinar and we encourage you to bring your questions live for our subject matter experts!

Indoor Heat Illness Standard Took Effect July 23

Posted by Eli Nuñez, HR Director on August 1, 2024

Tags: Employers Report

Ever since Cal/OSHA’s Standard Board adopted a new Indoor Heat Illness Prevention regulation (8 C.C.R. section 3396) on June 20, California employers have been eagerly waiting for more guidance, as well as an effective date. Both of these concerns are now addressed. The Office of Administrative Law (OAL) issued its final approval on July 20, 2024, and the standard took effect on July 23, 2024. Cal/OSHA updated its Frequently Asked Questions page to reflect this change.

While speculation was that the standard would not go into effect until sometime between August and October of this year, Cal/OSHA asked the OAL to expedite approval so the new rules would be effective as soon as possible.

Join CEA and Cal/OSHA for a free virtual Q&A on August 20, where Cal/OSHA Consultation will provide key insight into this new standard and the new Workplace Violence Prevention requirements. Register here now!

And, for more information on indoor heat illness requirements, keep reading:

Who Does the Indoor Heat Illness Standard Apply To?

To recap, the standard applies to all indoor work areas where the temperature equals or exceeds 82° Fahrenheit when employees are present. This regulation is aimed at workplaces like warehouses, restaurant kitchens, and manufacturing plants. Indoor workspaces where the temperature never exceeds 82° F, like office environments with functioning air conditioning, will not need to worry about this if the temperature never exceeds 82° F when employees are present.

Are There Any Exceptions?

The new standard does not apply to outdoor working conditions since these are already regulated by their own Heat Illness Prevention Standard. The new regulation did name some narrow exceptions including:

- Prisons, local detention facilities and juvenile facilities

- Teleworking employees where the location is not under the control of the employer

- Emergency operations directly involved in the protection of life or property

- Incidental heat exposure where a worker is exposed to temperatures between 82 and 95° F for less than 15 minutes in any 60-minute period. This exception does not apply to vehicles without working air conditions or shipping or intermodal containers during loading, unloading or related work.

What Must Employers do to Comply?

Employers must develop, document (put in writing) and implement procedures for complying with the requirements of this standard. In order to be complaint a Heat Illness Prevention Plan (HIPP) must include:

- Water: Procedures for providing sufficient drinking water.

- Cool-Down Areas & Breaks: Procedures for providing access to cool-down areas and breaks.

- Emergency Response Procedures: Including effective communication and first aid response.

- Acclimatization Methods: Including closely observing new employees and newly assigned employees working in hot areas during a 14-day acclimatization period.

And, when additional risk factors are present, such as when the temperature reaches or exceeds 82° F when employees are wearing restrictive clothing or working in high radiant areas (ovens, fire, etc.), or anytime the temperature reaches or exceeds 87° F, employers must also implement:

- Monitoring & Controls: Procedures for measuring the temperature and heat index and recording whichever is greater, identifying and evaluating environmental risks factors for heat illness, and implementing control measures.

What Else Will Employers Need To Do?

Covered employers must also train their staff on heat illness prevention and treatment, and the employer’s written heat illness prevention plan. For supervisors, employers must provide additional training on monitoring and responding to weather reports indicating excessive heat.

More information is available on Cal/OSHA’s Heat Illness Prevention and Guidance Resources page including educational materials and a model Written Heat Illness Prevention Plan employers can use to craft their own.

CEA members may call us with questions at 800.399.5331 or email us at CEAinfo@employers.org.

Employee Rights During Natural Disasters

Posted by Giuliana Gabriel, J.D., Vice President of Human Resources on August 1, 2024

Tags: Employers Report

In many areas, this summer has broken temperature records, creating raging fires in California, and hurricanes in other parts of the nation. From a human resource compliance perspective, there are employee rights that California businesses should consider, as well as options to assist employees when a natural disaster hits your community and impacts your staff.

Refusal to Report to Work

First, California employers should be aware of a relatively new law that went into effect last year, known as SB 1044, which allows an employee to refuse to report to work during an emergency condition.

More specifically, the law prohibits an employer from taking or threatening adverse action (e.g., discipline) against any employee for refusing to report to work or leaving the worksite when the employee has a reasonable belief it is unsafe due to an emergency condition.

An Emergency Condition is defined as either:

- Conditions of disaster or extreme peril to the safety of persons or property caused by natural forces or a criminal act; or

- An order to evacuate a workplace, worksite, or worker’s home, or the school of a worker’s child due to a natural disaster or a criminal act.

Of course, natural disasters may include events such as wildfires, flooding, earthquakes, etc. Criminal acts may encompass events such as bomb threats and active shooters.

Note that the law also prohibits an employer from preventing any employee access to their mobile device for seeking emergency assistance, assessing the safety of the situation, or communicating with a person to confirm their safety. As such, make sure that if you do restrict cellphone use in your workplace, your policies carves out emergency circumstances.

The law does not apply to specific groups, such as first responders and certain health care workers.

Reporting Time Pay

Employers may also wonder whether reporting time pay is owed if an employee shows up for work, but is sent home early due to a natural disaster. This would actually qualify as an exception to normal reporting time pay requirements, however, it’s not recommended to deny reporting time pay just based on “bad weather.”

As a refresher, in California, employers must generally pay a non-exempt employee “reporting time pay,” when the employee reports for their regular shift and works less than half of their scheduled shift. In this case, they must be paid at least half of their scheduled hours-never less than 2 hours, nor is it required to pay more than 4 hours.

Additional exceptions to reporting time pay requirements occur when:

- Operations cannot commence or continue due to threats to employees or property; or when recommended by civil authorities (e.g., bomb threat);

- Public utilities fail to supply electricity, water, or gas, or there is a failure in the public utilities, or sewer system (e.g., power goes out during a storm); or

- The interruption of work is caused by an Act of God or other cause not within the employer’s control (e.g., an earthquake, wildfire, etc.).

Employers should be cautious not to interpret these exceptions too broadly. For example, if there is a heavy rain storm, but the business still has functioning utilities, electricity, etc., guidance from the Labor Commissioner suggests employers should monitor the weather and anticipate scheduling issues. If you turn away employees because it is raining and it prevents them from doing work (e.g., harvesting produce), but it does not rise to the level of a natural disaster, reporting time pay is likely owed.

Leaves of Absence

Finally, beyond compliance, employers should consider the “human” side of natural disasters. For example, if an employee just lost their home and belongings in a wildfire, they will need time to recover, both from a practical standpoint and an emotional one.

Even if an employee does not have a protected leave of absence available, consider any optional leave policies, such as offering a personal leave of absence. Depending on your policy, a personal leave may be paid or unpaid, and you may choose whether to continue healthcare benefits during the leave.

For employers that offer Employee Assistance Programs (EAPs), make sure you communicate what services are available to employees, such as counseling.

For additional questions on employee rights and employer policy options, CEA members may call us at 800.399.5331 or email us at CEAinfo@employers.org.

Kim’s Message: We Appreciate You!

Posted by Kim Gusman, President & CEO on August 1, 2024

Tags: Employers Report

Last year I had a meeting at my credit union and instead of saying “thank you” when the meeting came to end, the person said, “appreciate you,” as we shook hands. That was the first time I’d heard that sentiment, and I liked it. Now I hear it all the time.

August is Membership Appreciation Month and we want to make sure you hear how much we appreciate you! We are pulling out all the stops to thank you for trusting your HR business needs to CEA! This month we are showering members with four free webinars, opportunities to win delicious gifts, and a grand prize trip to Lake Tahoe.

In 1937, a small group of business leaders founded the California Employers Association. Today we are proud to provide resources and services to hundreds of thousands of employers across the State. Formed in San Francisco by employers on the ports who initially needed support to comply with labor laws and work with unions, 87 years later we’ve developed a multitude of other services and training materials to help businesses thrive. From HR phone support and on-site assistance to employee relations and leadership training, our mission remains the same: Providing Employers With Peace of Mind.

Join in on the fun and freebies we’re offering our members this month:

Register for our Complimentary Virtual Events:

Sign up for any or all of our complimentary August virtual events. One lucky attendee per webinar will receive a $50 gift card to See’s Candies.

- Thursday, August 8 – The Stay Interview Advantage

- Thursday, August 15 – Navigating Leaves of Absence in the Workplace *Presented by Duggan McHugh

- Wednesday, August 21 – Top 10 Mistakes Employers Make that Invite Wage and Hour Class and PAGA Actions *Presented by Ogletree Deakins

- Tuesday, August 27 – How to Spot a Workplace Bully

Member Engagement Survey

Penny for your thoughts! In August, all members will receive an email from SurveyMonkey with our Annual Member Engagement Survey (check your spam filter). Provide your feedback and be entered for a chance to win a $100 Visa gift card!

Tag-You’re It!

Show off your business! We love getting to know our members, so give us a glimpse into your daily operations. Show off your products, employees, or some of your favorite CEA items on your social media. Tag CEA or use #CAemployers and be entered in our Grand Prize Drawing with every post.

Show Your CEA Pride!

We are proud to have you as a CEA Member and hope the feeling is mutual. In August, members will receive an email about Member Appreciation Month with two member badge designs. Choose one to download and place on your website, then send us a screenshot to marketing@employers.org to gain another entry in our Grand Prize Drawing.

Grand Prize Drawing

The lucky winner of our Grand Prize Drawing will enjoy a one-night stay and round of golf at the Everline Resort & Spa in Lake Tahoe!

4 Opportunities to Enter the Grand Prize Drawing

- Attend any of our free webinars

- Complete the member engagement survey

- Add the CEA Member badge to your website

- (Hash)tag us on social media using #CAemployers

Thank you for being a CEA Member-there is strength in numbers!

We hope you enjoy the rest of your summer and know how much we appreciate you,

We want to feature you in an upcoming Employers Report!

Each August, we celebrate our valued members with prizes and free webinars during Member Appreciation Month; but we want to do more to put our members in the spotlight year round! If you are interested in having your company featured in our Monthly Member’s Spotlight, email Marketing@employers.org for details!

Membership Appreciation Month Official rules: California Employers Association is the sole sponsor of this contest. There are four (4) methods of entry: 1. Attend any of our four (4) free webinars. Must be in attendance to win. 2. Share your social media photo and tag CEA or use #CAemployer. Earn one (1) entry for each tagged post. CEA retains rights of all entries to use across marketing collateral. 3. Complete the member engagement survey. 4. Add the CEA member badge provided in the Member Appreciation Month email to the company’s website and send a screenshot to marketing@employers.org. Limit one (1) entry per person. Entries must be received between August 1, 2024 – August 31, 2024. The grand prize is eligible to active CEA members. Winners will be selected at random. CEA will reach out to the winner after random selection. The winner will have three (3) business days to reply back and claim the prize. CEA reserves all rights.

Member Appreciation Month Preview

Posted by California Employers Association on July 1, 2024

Tags: Employers Report

Our valued members are the reason that the California Employers Association was founded in 1937! As a thank you for being a member, we dedicate every August to YOU! Yes, we realize it’s only July but now is the time to sign up for next month’s exciting events.

Here’s How to Join the Fun!

4 FREE Virtual Events Just for Members!

Register TODAY for any or all of our complimentary August virtual events: One attendee will be selected out of each webinar to receive a $50 gift card.

- Thursday, August 8 – The Stay Interview Advantage: Retaining top talent is crucial for organizational success. Stay interviews are part of a healthy, transparent and positive work culture. Whether you’re an HR professional, or a team leader, mastering the art of the stay interview can significantly impact your organization’s ability to retain top talent and foster a culture of continuous improvement and employee engagement.

- Thursday, August 15 – Navigating Leaves of Absence in the Workplace *Presented by Duggan McHugh: Delve into the intricacies of managing leaves of absence in the workplace. From understanding legal requirements to implementing best practices, this session will equip you with the knowledge and tools necessary to navigate through employee absences effectively.

- Wednesday, August 21 – The Top 10 Mistakes CA Employers Make that Invite Wage and Hour Class and PAGA Actions *Presented by Ogletree Deakins: The filing of wage and hour class and PAGA actions are on the rise. Join Mike Nader, a Shareholder in the Sacramento office of Ogletree Deakins to review the Top 10 mistakes that California employers make that cause significant liability in this crippling litigation, and how to avoid them.

- Tuesday, August 27 – How to Spot a Workplace Bully: Join CEA’s subject matter experts as they provide tools for recognizing common bullying patterns and tendencies, and inspire confidence in how to respond, through specific strategies.

Member Engagement Survey

Penny for your thoughts! In August, members will receive an email from SurveyMonkey with our Annual Member Engagement Survey (check your spam filter). Give us your feedback and be entered for a chance to win a $100 gift card!

Tag-You’re It!

Show off your business! We love getting to know our members, so give us a glimpse into your daily operations. Show off your products, employees, or some of your favorite CEA items on your social media. Tag CEA or use #CAemployers and be entered in our Grand Prize Drawing with every post.

Grand Prize Drawing

The lucky winner of our Grand Prize Drawing will enjoy a one-night stay and round of golf at the Everline Resort & Spa in Lake Tahoe!

3 Opportunities to Enter the Grand Prize Drawing

- Attend any of our free webinars

- (Hash)tag us on social media using #CAemployers

- Complete the member engagement survey

Thank you for being a CEA Member-there is strength in numbers!

Official rules: California Employers Association is the sole sponsor of this contest. There are three (3) methods of entry: 1. Attend any of our four (4) free webinars. Must be in attendance to win. 2. Share your social media photo and tag CEA or use #CAemployer. Earn one (1) entry for each tagged post. CEA retains rights of all entries to use across marketing collateral. 3. Complete the member engagement survey. Limit one (1) entry per person. Entries must be received between August 1, 2024 – August 31, 2024. The grand prize is eligible to active CEA members. Winners will be selected at random. CEA will reach out to the winner after random selection. The winner will have three (3) business days to reply back and claim the prize. CEA reserves all rights.

Summer Vacations & Time Off Dilemmas

Posted by Eli Nuñez, HR Director on July 1, 2024

Tags: Employers Report

Schools out…for summer! As the weather warms up, people begin thinking more about vacation and in some industries, summer months also result in increased work demands. Many employers are finding themselves trying to balance staffing demands with their employees’ need to take time away to recharge their batteries. Now is a good time to review your employee handbook to see if your policies and procedures around paid time off are clear and easy to understand, by both employees and your management team.

California Law and Vacation

While most employers in the Golden State provide paid time off to their employees, beyond mandatory sick time, there is no legal requirement to provide vacation time. If your company chooses to offer paid vacation (and we highly recommend this) it’s important to have a clear, well-crafted vacation policy that specifies exactly how much vacation is provided, how and when it is accrued, and the maximum amount an employee can save or rollover.

Your paid time off/vacation policy is also a great place to communicate how your company approves time off and the steps employees need to take to request time off.

What if your business wants to designate “blackout dates” throughout the year when employees may not use vacation? No problem. Employers have the right to determine when vacation is taken and how much can be taken at a time to maintain adequate staffing levels.

Unlike other states, California considers vacation a form of wages, so there are some protections in place for your employees, including:

- Employees must be paid for all accrued and unused vacation upon termination of employment

- No “use it or lose it” policies are allowed: unused time must either be allowed to “roll over” or paid out to employees

- Employers can place a reasonable cap on vacation accruals (but it must be at least 1½ times their annual accrual rate)

- Watch how you define floating holidays/personal days. If not worded properly, you may be required to offer the same protections for these “perks” as you do for vacation time.

Combining Vacation & Paid Sick Leave

If your organization has chosen to combine vacation and paid sick leave into a single Paid Time Off (PTO) policy, be aware that additional protections will apply. In this case, all the protections of paid sick leave and vacation apply, meaning:

- All accrued and unused time in the PTO bank is payable upon termination

- California paid sick leave protections apply to PTO, meaning that the employer should not request a doctor’s note for the use of PTO when it is taken for sick leave purposes, and no punitive measures may be taken against the employee for that missed time

If you have any questions about your vacation or PTO policy, we’re here to help. CEA members can download fact sheets on Vacation and Paid Sick Leave, on the HR Forms page, or consult one of our HR Advisors by email or over the phone at 800.399.5331. Time to update your employee handbook? Purchase our Do-It-Yourself Employee Handbook to lighten your load.